While I don’t have the time to play much WoW any more, one think I decided a few month ago was to try out and see how hard it is to accumulate the maximum possible amount of in-game currency in the game. WoW uses a signed 32 bit integers to track the amount of coins you carry, thus the maximum is 2^31 = 2,147,483,648 copper or 214,748 gold, 36 silver and 46 copper. In practice my experience was that the limit is two copper lower, but who is counting.

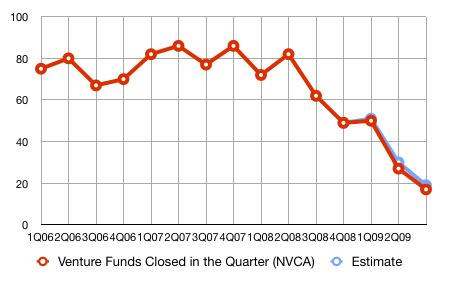

It turns out that virtual economies like WoW are still very inefficient. The arbitrage opportunities and price fluctuations in the in-game auction house are large, and creating crafted items from raw materials often yields margins of 30% and higher. My initial assumption had been that working capital would be the main limitation for how quickly I could grow, but that turned out to be wrong. Instead market size and “shelf space” day set the limits for growth. The server I play on has an “active” market of about 2k players during peak hours (source). Assuming the average player spends 100g per day, this means the total addressible market is only 200k gold. About half of this market consists of items that are found in-game and not produced. Of the other 100k I was able to capture about 10%-20% a day for revenue of 10k-20k and profits of about 2k-3k. The main reason for only capturing a small part of it is that I listed items on the market only once a day, and would often get undercut quickly. Thus often I was only the cheapest provider for a small part of the day.

The in-game time keeping suggests it took about 170 hours of play time to to the peak, or around 1000g/hour. The WoW gold exchange rate fluctuates, but a quick survey suggests an exchange rate of around 150g = $1. Thus my account is now worth in the order of $1500 (although it is non-trivial to liquidate that much gold) and I made $8.30 per hour. While that is more than the the California Minimum Wage of $8, for now I’ll stick to my day job.