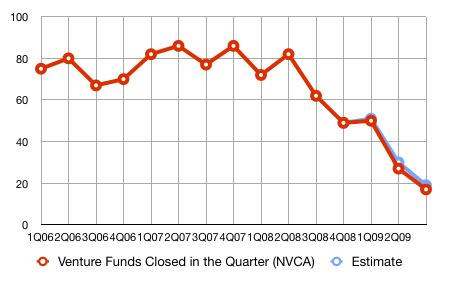

The latest NVCA Numbers on fundraising of VC Funds are here, and essentially it is falling of a cliff. In Q3 of 2009 only 17 funds raised capital. While this will probably go up to 18 or 19 (initial numbers by the NVCA usually are corrected upwards in their later reports) this is still abysmal.

Based on the back-of-the-envelope math in my previous post this rate of fundraising would mean venture captial would shrink to a little over 200 firms or a quarter of its current size. While possible, that seems pessimistic. From what I hear from people in the VC industry, there is at least some evidence that investors are still interested in VC as an asset class and investments will increase as the liquidity of long-term investors gets better. I think there is a chance that this is the low point of the fund raising activities for this downturn.

VC Fundraising falls off a cliff

The NVCA Numbers are here, and they look worse than I would have expected. Only 25 new funds were raised in Q2/2009 vs. 82 funds in Q2 of last year.

Typically the initial tally by the NVCA increases by 15% or so as additional closes are announced (see Estimate in the graph for where I think we will end up), but even then this number is very low the worst we have seen in the last decade. Total capital raised was $1.7 billion.

Venture Capital Decline

When Morgenthaler raised their last fund I wrote that it looks like Venture Capital is ready for a shake-out. If anything the Q4 numbers from the NVCA/Venture Economics confirm this trend. Below the graph for Venture Funds closed for each quarter over the past 3 years.

Only 43 venture funds where closed in Q4, and the total capital raised was $3.3 billion. This is down from 84 funds raising $11.6 billion a in Q4 of 2007. This brings venture fund raising back to the levels we saw right after the crash of 2000. I would expect to see a further decline for all of the next year in both number of funds as well as total capital. What this means for the venture industry is that if you have fully invested your old fund, and not yet raised a new fund (or at least had an initial closing), you may be in a very difficult situation. Howeve if you just raised a fund, you can expect less competition (and thus hopefully better returns) in the next few years.

Morgenthaler Announces Closing of 9th Fund

Morgenthaler Ventures (where I am currently an EIR) announced today that they closed their ninth fund. In a normal market, this would have been business as usual and not be particularly newsworthy. However the current financial markets are anything but normal.

According to the NVCA release, the number of venture funds closed over the last quarters is:

1Q'07 83

2Q'07 83

3Q'07 78

4Q'07 85

1Q'08 70

2Q'08 76

3Q'08 55

In 3Q of this year we saw a steep drop. However the impact of the current liquidity crisis and the resulting stock market decline didn’t become fully apparent until October. If I would have to bet, I would expect 4Q to look a lot worse. Venture Beat recently wrote about this and concluded that essentially what we are seeing, is a shakeout in the VC industry. While I haven’t seen numbers yet that conclusively demonstrate this, it intuitively makes sense. Firms that were burnt badly in the post-bubble of 2000-2003, now have fully invested their funds and realize that in the current financial climate they can’t raise additional capital. One would expect new entrants in the Venture Capital space to be the most vulnerable. A firm like Morgenthaler with almost 40 years of track record and an established network of LP’s is naturally in a much better position.

Continue reading “Morgenthaler Announces Closing of 9th Fund”