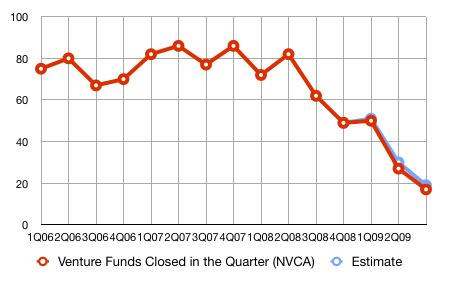

The latest NVCA Numbers on fundraising of VC Funds are here, and essentially it is falling of a cliff. In Q3 of 2009 only 17 funds raised capital. While this will probably go up to 18 or 19 (initial numbers by the NVCA usually are corrected upwards in their later reports) this is still abysmal.

Based on the back-of-the-envelope math in my previous post this rate of fundraising would mean venture captial would shrink to a little over 200 firms or a quarter of its current size. While possible, that seems pessimistic. From what I hear from people in the VC industry, there is at least some evidence that investors are still interested in VC as an asset class and investments will increase as the liquidity of long-term investors gets better. I think there is a chance that this is the low point of the fund raising activities for this downturn.

VC Fundraising falls off a cliff

The NVCA Numbers are here, and they look worse than I would have expected. Only 25 new funds were raised in Q2/2009 vs. 82 funds in Q2 of last year.

Typically the initial tally by the NVCA increases by 15% or so as additional closes are announced (see Estimate in the graph for where I think we will end up), but even then this number is very low the worst we have seen in the last decade. Total capital raised was $1.7 billion.

EIR at Morgenthaler Ventures

A few people mentioned that they were suprised about my move to Stanford after leaving Voltage. This post should be a lot less suprising: I am joining Morgenthaler Ventures as a part-time Entrepreneur in Residence. Spending a day a week at Morgenthaler Ventures is a very synergistic combination. The exposure to bleeding edge technology in Stanford helps understanding entrepreneurial opportunities. Vice versa seeing the hard technical problems that portfolio companies face helps define meaningful new research areas. And while some of you may not have heard of them before, Morgenthaler is a great firm to work with.

Moving on…

Friday last week was officially my last day as an employee at Voltage. The company has been doing great, both in terms of the organization as well as market traction. However after working there for 6 years it felt like it was the right time to move on. Since we founded it in 2002, Voltage has developed from being an early stage technology venture, to a stable, self-sufficient leader in enterprise software. And this means I can move on to do something new.

Building a company is primarily about finding the right people and building the organization. Conversely, the in my count most common cause of death for an early stage start-up is dysfunctional team. At Voltage, we started with a founding team that shared a common vision and terrific investors that were an incredible help whenever we needed them (picture of the early days on the right). On these foundations we together built the great organization that Voltage is today. I am grateful for having had the opportunity to work with everyone in the company, from the executive team, to the board to each and every employee. In retrospect there are only few hires that I would not make again. Going forward I am confident we have the team in place that has what it takes to guide Voltage into the future.